06 Apr Non-Fungible What?

We’ve been getting a lot of questions from graphic artists about NFTs: What on earth are these? Is this a good way for us to sell our art? What is someone selling when they create an NFT anyway? And what do we need to watch out for?

The more we look into NFTs, the more questions we have. What is clear is that, like other technology innovations, NFTs have disrupted traditional marketplaces – notably the market for visual arts. This can be good news for visual artists. For once, instead of watching infringers gleefully download and monetize their digital work, artists have a marketplace in which they can reach a new, hungry audience. At the same time, NFTs extend the same opportunities to bad actors, to the detriment of both artists and art buyers.

NFT: Non Fungible Token

“Non-fungible” means something unique which cannot be interchanged, and “token” means something which represents something else. As with the cryptocurrencies bitcoin and ether, NFTs reside in the blockchain. However, similar to real currencies (and unlike NFTs), cryptocurrencies are interchangeable in divisible units. NFTs exist as unique, whole tokens. While each NFT contains a non-transferable identity that can’t be altered, they are extensible – two NFTs can be combined to create a third unique NFT.

NFT Resource List

Thank you to Julie Swigart for sharing her comprehensive list of learning resources

Since they are unique, NFTs can “tokenize” digital assets, like artwork, animations, music, digital real estate, and even the first-ever tweet. NFTs permit transactions that are simplified and efficient. Since the data about the NFT is permanently encoded within the blockchain, there is a lower risk of fraud in the NFT purchase transaction. For artists, NFTs permit transactions directly with art buyers, eliminating the middleman. The blockchain metadata fields for an NFT can contain information the artist may want to include, such as their signature, licensing terms, or copyright transfer. Many NFT marketplaces also permit artists to set a resale fee so that as their artwork is sold from buyer to buyer, they receive a passive income.

What is essential to understand about NFTs is that the digital artwork itself does not reside within the blockchain with the NFT. Instead, the NFT functions as a frame that points to an address for the artwork. Independent reporter Amy Castor writes on financial fraud and cryptocurrencies. As she puts it, “Really, an NFT is simply proof that an object exists.” Unless the artist has explicitly included usage rights or a transfer of copyright as part of the transaction, the NFT does not transfer any rights to the artwork. The buyer of an NFT can’t prevent other people from viewing the artwork, downloading it, or otherwise control that work outside whatever safeguards exist on the server on which the artwork resides.

So, what exactly is the buyer getting when they purchase an NFT? Essentially, the buyer purchases proof of ownership and authenticity – or “bragging rights” – to an original piece of digital artwork. The purchase includes whatever terms or information the artist decides to include within the blockchain data fields. Some artists include copyrights, licensing options, or even printed, signed copies of the artwork to sweeten the deal.

Buyer Beware

Buyers of NFTs need to be certain of what they are purchasing. Similar to buying a physical work of art – a painting or a sculpture – the buyer does not automatically receive the copyrights to the work. Absent any usage rights or other conditions included in the NFT, the artist can continue to use the artwork as they see fit. Other than reselling the artwork, the buyer can’t monetize the artwork (by selling copies or putting it on t-shirts, etc.). These are the same limitations that apply to physical artwork – the proud owners of a painting can’t put their prized artwork on their company brochure, for example.

That also means that an unscrupulous seller might make a copy of the artwork an NFT points to and sell that. Since the degradation from digital copy to digital copy is minimal, that means your original purchase may be indistinguishable from other NFTs.

Another risk a buyer will take is that a seller may pull the rug out on them – swap the image they thought they were purchasing for something else. The Writer’s Lounge (a collection of blockchain aficionados) described how an NFT “rug pull” can occur in their article, “Phantasma Decentralized Smart NFTs.” The example they used was a rug pull by digital artist Neitherconfirm, who swapped out the artwork for 26 NFTs he was selling on the OpenSea marketplace for images of rugs. Neitherconfirm could do this in part because the cryptographic hash for those NFTs, the bit of code that identifies the artwork as authentic, was not stored in the blockchain but rather on a centralized server.

I just pulled the rug at my NFT collection on @opensea . Nobody got hurt.

— neitherconfirm (@neitherconfirm) March 9, 2021

It is pretty easy to change the jpg, even if it does not belong to me or it is on auction. I am the artist, my decision, right?

A thread from somebody making his living with art irl about the value of NFTs. pic.twitter.com/LNAZqPpDMZ

Many blockchains store the metadata for NFTs on a centralized server rather than in the blockchain, leaving buyers vulnerable to losing their investment if an unscrupulous seller pulls the rug out on them. That might not be likely to happen – after all, artists have a vested interest in selling their work and are unlikely to stiff their buyers. A more serious concern with centralized hosting of the NFT metadata is that if the hosting server goes down, the buyer will lose their investment. There are a number of ways technology addresses storage and data persistence, but as this article from Coindesk makes clear, best practices for long-term storage of the digital content the NFT is pointing to are still up in the air.

Artists Be Aware

NFTs are providing artists with a direct way to sell their digital work. The experience is sweet after decades of having their work stolen and copyrights infringed by clueless (or entitled) right-clickers. But NFTs have also enabled bad actors to tokenize and sell works they’ve simply nabbed from artists without permission. In their article, NFT Mania is Here, and So Are the Scammers, The Verge reports that artists have discovered that their work is being sold in NFT marketplaces like OpenSea, Marble Cards, and Rarible. While the marketplaces will remove NFTs pointing to infringed artwork, the onus is on the artists to monitor the websites for the unauthorized selling of their work.

Once the unauthorized selling of an NFT is unearthed, the marketplace may take its time to moderate the fraudulent sale. Artist Derek Laufman discovered his work being sold on the Rarible marketplace by someone who pretended to be him through the platform’s verification process. It took publicizing the fraud via social media for Rarible to remove the fraudulent NFTs. While Rarible’s delay might be explained by their need to confirm that the user had gamed the verification process, that process itself is part of the problem.

Marketplaces have varying requirements for individuals to verify that they are who they say they are before participating. According to the Verge article, Rarible only requires submissions of social media handles (which it doesn’t appear to bother to confirm), and OpenSea requires no verification.

Requiring a seller to verify that they are who they say they are is one thing. Requiring the seller to verify that they own the artwork, or have the right to sell it, is another entirely. NFT marketplaces do not appear to have robust (if any) processes in place to prevent fraudulent sales, leaving it to the buyer to do their due diligence (and leaving artists with another infringement headache). Some marketplaces are even removing barriers to selling. On March 13, OpenSea tweeted that they would no longer require NFT collections to be submitted for approval but would immediately make them public.

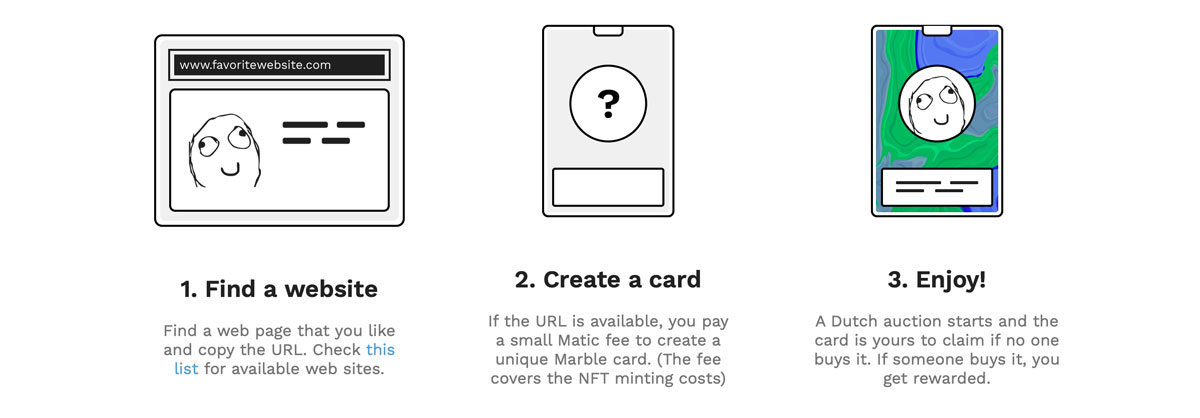

Some marketplaces have sidestepped the issue of copyright infringement entirely, essentially washing their hands of any responsibility to artists and copyright holders. Marble Cards permits sellers to create a frame around the URL of any image they like. Their website encourages the “marbling” of any URL, and the shared image is cached on their servers. They dodge potential copyright ownership issues by claiming that the display of marbled artwork is “fair use.” They base this claim on the fact that Marble Cards uses the Open Graph protocol to identify URLs of content to be marbled. The Open Graph protocol was created by Facebook and permits the sharing of page content. Marble Card’s claim of fair use that stretches the definition, at a minimum.

Marble Cards blithely instructs potential NFT sellers to “find a website you like” to embed the URL of an image.

The problem isn’t just sellers nabbing artwork that they tokenize without permission, or through a process like Marble Cards’. Artists have also seen work they created for past commissions suddenly appearing on NFT marketplaces. Kotaku reported that game artists discovered their artwork was being auctioned off by Rohrer, a developer of indie games. When Rohrer commissioned the artwork for his games years ago, he notified the artists that their work would be auctioned, bought, and auctioned again. However, those were in-game auctions, not external NFT auctions. Rohrer complied with the artists who asked him to remove their artwork from the NFT auction website. But for some artists who Rohrer characterized as “personal friends and family,” the NFT auction was a bridge too far.

Another concern with NFTs is based on artist behavior. In a bid to make a sale, artists bundle rights and conditions into their NFT. As more and more artists enter the marketplace and competition for high sales become steeper, the temptation is to include a transfer of copyrights into the NFT. That is a drastic step which, if it becomes commonplace, would mean that buyers could start to expect a transfer of copyrights as a given. That would deprive the artists of their valuable copyrights, and would contribute to the degradation of the understanding of the role copyright plays in artists’ livelihoods.

To Tokenize or Not

The NFT marketplace is rapidly growing and rapidly evolving. The hope is that responsible marketplaces will develop safeguards to protect both buyers and artists. For now, NFTs offer a marketplace for artists to monetize their work to a fresh audience directly. The potential for lucrative income is there, and that’s good for artists.

The dark side, of course, is that opportunity is also available to infringers. As with every technological development, the burden of discovering and dealing with infringements lies with the artists. It’s disheartening how little the marketplaces are concerned with this.

The Graphic Artists Guild is working on best practices for participating in NFT marketplaces. For now, the best advice is to register your copyrights, particularly for your online work. The other bit of commonsense advice is to always use a contract for commissions, even for ones in which you’re “donating” the artwork. Doing so will limit any further use of your artwork, prohibiting the sale of the work as an NFT.

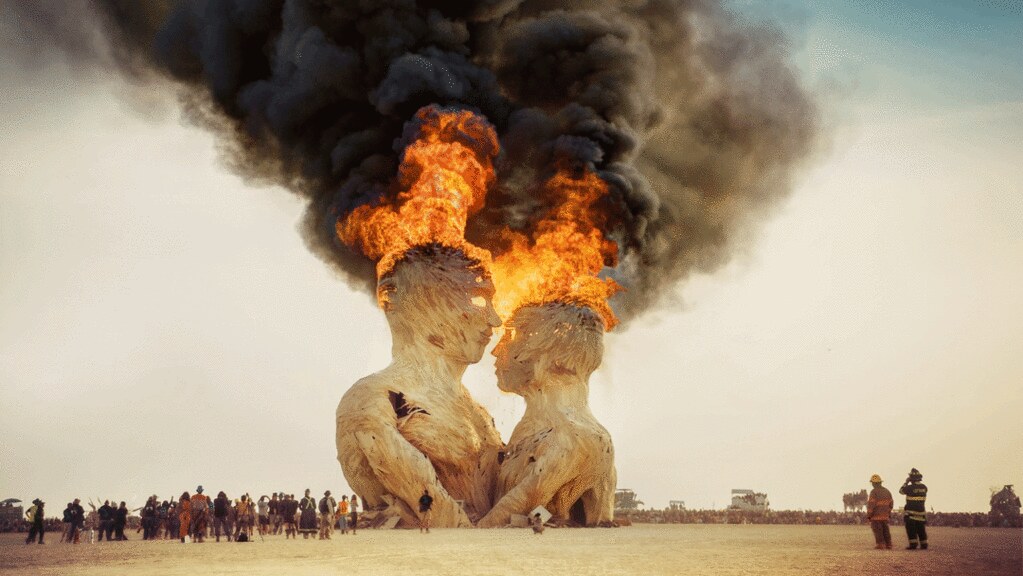

Featured image: Burning Embrace by Matt Schulz and The Pier Group, NFT artwork posted by Trey Ratliff on Flckr (CC BY-NC-SA 2.0)

Burning Embrace was tokenized into an NFT by Trey Ratckliff and auctioned off for charity on the Foundation NFT marketplace. The work was sold for 7.15 ETH (or $15,169.23). 5% of the sales price was given back to the original artist. Read Trey Ratcliff’s description of the transaction on his flickr account.